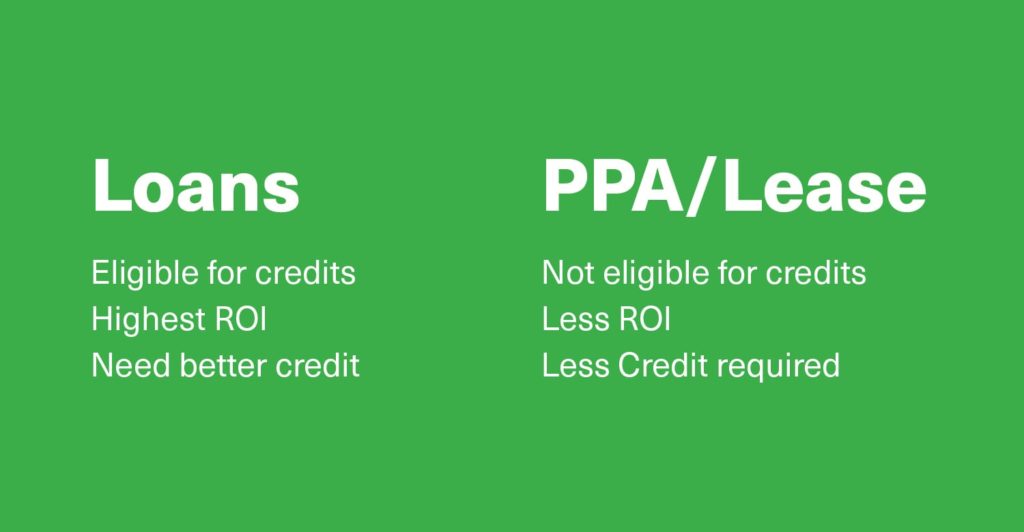

There are four ways you can get zero down financing for a solar power system on your property. One way is to lease the system. In a lease, you pay to rent the solar power system, typically for about 20% less than you were paying for electricity. Power Purchase Agreements (PPA) work much like solar leases, but instead of renting the system, you agree to pay a set price for the electricity the system produces. If you want to own your solar power system, depending on your credit and how much equity you have in your home, you could qualify for either a secured loan or an unsecured loan. Whether it’s smarter for you to go with zero down financing for a lease, PPA or a loan depends on your individual circumstances.

Freedom Forever has zero-down financing options for credit scores as low as 600!

When is a zero down lease or PPA the best option?

If your primary goal is to lower your electric bill, your best option is to finance your solar power system. Owning your system produces the highest savings in the long run. If a loan isn’t an option for you, a lease or a PPA may be the best option for you.

Another consideration is how much you pay in federal tax. If you pay little or no tax, you may not benefit that much from the very generous 30% Federal tax credit. That would lower your overall savings somewhat, but even so, buying your system is still your best option. The tax credits and incentives available for solar systems can reduce your price for these systems significantly. But if you don’t qualify you’d be on the hook for the full price of the system. If the system isn’t affordable without those credits, then a lease or a PPA might be an attractive option.

Advantages of zero down leases and PPAs

- Lowers your electric bill

- You’re not responsible for maintenance and repairs

- You don’t have to wait a year to receive the financial benefit of the tax credits

Disadvantages of zero down leases and PPAs

- You don’t add value to your home

- You don’t get the tax credits or incentives

- Unlike ownership, you never stop making payments

When is zero down financing the best option?

Zero down financing for a solar power system is the best option if you want all three major benefits: Lower your electric bill, add value to your home, and earn profits from the power your system produces. The average homeowner will break even on their investment in about 8 to 10 years. A solar power system will last for decades and everything you earn after breaking even on your system is money in your pocket. Plus, depending on which type of loan you get, the interest may be tax-deductible.

Secured vs unsecured loans

If you decide to take out a zero-down loan to buy your system, you’ll need to choose between secured and unsecured loans. Each has its advantages and disadvantages. Both types of financing make you eligible as system owner for any Federal and state tax deductions and other incentives that are available.

Secured loans

Secured loans use your home or some other asset as collateral. If you fail to make your payments, the bank seizes the asset that you secured your loan with. Secured loans represent less of a risk to the bank than unsecured loans, so they often come with lower interest rates and are easier to qualify for. To qualify for a secured loan, you must have enough equity in your home (or some other asset) to cover the cost of the loan. The interest on secured loans is tax-deductible.

Unsecured loans

Unsecured loans don’t require any collateral. If you don’t make your payments, it will affect your credit score and, worse, you may get sued by the bank. Unsecured loans are riskier for banks, so they are harder to qualify for and usually have higher interest rates than secured loans. The interest paid on unsecured loans isn’t tax-deductible. Unsecured loans will often come with hidden origination fees. Those fees are paid by the solar power installer company and often passed on to you in the form of a higher price for the system.

Differences between secured and unsecured loans

| Secured loans require collateral No origination fees Interest is tax-deductible Usually have lower interest rates Easier to qualify for | Unsecured loans Don’t require collateral May have hidden origination fees Interest isn’t tax-deductible Usually, have higher interest rates Harder to qualify for |

Government secured loans

For people who don’t have the credit to qualify for a loan from a bank, there are government-sponsored loans that they may qualify for. These loans are backed by the government. If you fail to make your payments, the lender is able to collect some or all of the balance of your loan from the government.

FHA loans

Federal Housing Administration (FHA) loans are insured by the FHA. Like secured loans, FHA loans are secured by your house, and the interest is tax-deductible. But unlike secured loans, if you default on an FHA loan, the bank won’t foreclose on your home. The bank can instead collect up to 90% of the loan’s value from the FHA.

PACE loans

Property Assessed Clean Energy (PACE) loans are offered by some local governments. These loans are paid back by a property tax assessment on the home over the course of 10 to 20 years. These loans stay with the home and transfers to a new owner if you sell it before the debt is fully paid off. The only way you can default on them is to fail to pay your property taxes.

Which type of zero down financing is right for you?

The answer to this question depends on lots of factors, such as your income and credit, plus how much equity you have in your home. Your best bet is to consult with a solar power professional who understands solar power finance. They will be able to advise you on the best option for your home. The Freedom ForeverTM family can connect you with an independent solar power dealer who is an expert in home solar finance.

You can obtain a free, no-obligation consultation simply by contacting us and requesting a free quote.