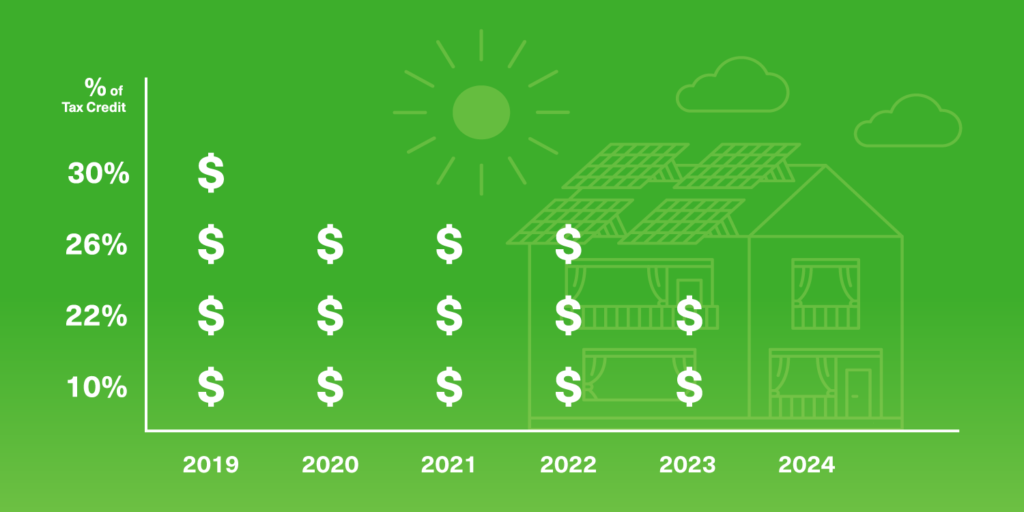

The Federal Tax credit for solar power currently allows you to deduct 26% of the cost of your solar system from the tax you owe or have already paid in income taxes at the end of the year. The credit is being phased out. Solar systems that begin installation before December 30th, 2022 are eligible for the full 26% tax credit. Systems that begin installation after Jan 1st 2023 will only be eligible for a 22% tax credit. The Federal Tax credit will be phased out after that.

Why you must install as soon as possible to ensure you get the full tax credit

Keep in mind that solar systems must begin installation by December 30th, 2022. A system that has begun installation is one that significant construction has begun on. A solar system takes some time to plan and install. In California, Freedom Forever’s average install time is 21 days. After installation, it can take several weeks for the utility company to inspect it. If the system passes, it receives PTO in about one to two days. If it doesn’t pass, it could take a week or more for the utility company to reinspect it. Utility companies can delay a project by several weeks. Because of that, if you plan to go solar, and want the maximum tax credit, the best time to go solar is right now.

What is the phase-out period for the Federal Tax credit for solar?

The solar tax credit remains at 26% of the price of the system for systems that begin installation by December 30th, 2022. After that, homeowners with systems that begin installation by December 30th, 2023 are eligible for a 22% tax credit. In 2024 the credit for homeowners phases out entirely. After that, only commercial solar system owners are eligible for the Federal Solar Tax credit. They are allowed to deduct 10% of the cost of their system. Homeowners would no longer be eligible for the Federal Tax Credit.

How does the Federal Tax credit for solar work?

The Federal Tax credit for solar is a credit against the amount of income tax you owe or have already paid at the end of the year. If when you do your taxes, you get everything you pay in income tax back from the IRS, then you won’t get anything back from the Federal Tax credit for solar. If you owe less than the full amount of the tax credit than you are eligible for, then you can continue to deduct the remaining tax credit for up to five years after you first filed for the credit.

Example:

If you paid $20,000 for your system, you’d be eligible for a $6,000 tax credit. Should you owe or have already paid $6,000 in income tax, you can claim the entire tax credit. If you owe or have paid less than $6,000 in income taxes, you can deduct the full amount of what you owed or have paid. You can continue to deduct the remainder of the tax credit for up to five years after you bought your system.

You should contact a qualified tax expert and consult with them. Neither Freedom Forever’s family of independent authorized dealers nor Freedom Forever itself can give you tax advice. A qualified tax professional will understand your situation and be able to give you the most relevant advice.

Can Freedom Forever help me find out how much I’d be eligible to receive?

Freedom Forever and our family of Independent Authorized Dealers are not tax experts and can’t give you tax advice. What we will do is help you plan a system that fits your needs. You should then take the estimated cost of that system and your financial information to a tax professional. They will be able to advise you on how much money you are likely to receive from the Federal Tax credit.

State solar incentives may help you save even more

The Federal Tax credit isn’t the only incentive out there for you to go solar. Your state and the utility company that supplies your power may have additional incentives. The Freedom Forever’s family of Independent Authorized dealers are knowledgeable of the incentives available in your area. When you schedule an appointment to speak with a representative about going solar, they will discuss all applicable incentives with you. Getting started is easy, just call or click, and we’ll take care of the rest.

Go solar, get the benefits you deserve. Call us at 800-685-1850 or click below to get a quote.

Reference

Energy.gov. (2019) Residential Renewable Energy Tax Credit. Web 16 April 2019

https://www.energy.gov/savings/residential-renewable-energy-tax-credit